Content

Simplify your month-end process with crypto accounting software. Learn how to streamline transactions, ensure compliance, and enhance financial reporting.

Are you tired of juggling multiple spreadsheets and struggling to reconcile your crypto transactions? Do you dream of a smoother, faster month-end close that leaves you with time to actually enjoy life outside of work? You're in the right place. This guide will show you how crypto accounting software can revolutionize your financial management, freeing you from manual processes and empowering you with real-time insights. It's not just about saving time; it's about gaining control of your crypto finances and achieving a better work-life balance. Let's explore how the right software can transform your crypto accounting from a source of stress into a source of empowerment.

Cryptoworth simplifies the entire crypto accounting process—from daily reconciliation to smooth month-end closes. With automated tracking across exchanges, wallets, and blockchains, Cryptoworth ensures your month-end reporting stays accurate, compliant, and stress-free.

Key Takeaways

- Automated crypto accounting saves time and reduces errors: Streamline complex transactions, reporting, and compliance, giving your team more time for strategic work.

- Software selection depends on your specific needs: Consider transaction volume, integrations, and features like DeFi support when choosing a platform.

- Proper implementation ensures accurate reporting: Clean data, thorough testing, and team training are crucial for successful software integration.

What is crypto accounting software?

Crypto accounting software helps businesses track, manage, and report cryptocurrency transactions. It simplifies data aggregation and cost basis tracking, supporting accurate recordkeeping for companies working with digital assets.

Key features and functionalities

Good crypto accounting software automates transaction tracking from various sources like wallets, exchanges, and blockchains. It calculates gains and losses and generates compliant reports. Many platforms integrate with existing financial systems, streamlining your accounting workflow. Some platforms offer tools for generating gain/loss reports that can be used for tax reporting or portfolio analysis.

Why your business needs it

Cryptocurrency transactions are complex. Keeping detailed records is essential for accurate financial reporting and tax compliance. Specialized software helps manage this complexity, ensuring you're following the rules and regulations. Accurately recording every transaction can be tough, especially with high volumes. Crypto accounting software streamlines this process, reducing errors and giving your team more time for strategic work. It also helps avoid penalties from misclassified fees. Good record-keeping is important for any business, especially those dealing with the complexities of cryptocurrency. Using the right tools makes this much easier.

Challenges of managing crypto transactions without specialized software

Managing cryptocurrency transactions without the right tools can feel like trying to solve a puzzle with missing pieces. Let's break down the main challenges.

Tracking multi-exchange transactions

If your crypto transactions are spread across multiple exchanges, tracking them with spreadsheets can quickly become a nightmare. Most standard accounting software isn't built for digital assets. This often leads to messy workarounds, cobbled together with spreadsheets, add-on tools, and manual data entry. As one source explains, businesses often resort to "duct-tape-style solutions" using a combination of tools. This not only wastes time but also increases the risk of errors. Accurate reconciliation becomes a major headache, especially with high transaction volumes.

Valuation and cost basis calculation issues

Figuring out the value of your crypto holdings and calculating the cost basis for tax purposes is another hurdle. Crypto prices change constantly. Determining the fair market value at the exact time of each transaction is essential. This requires precise record-keeping and often involves complex calculations, especially if you're using accounting methods like FIFO or average cost. Accurately calculating the fair value at the transaction time is crucial. Without specialized software, this process can be incredibly time-consuming and prone to mistakes.

Regulatory compliance hurdles

Keeping up with evolving crypto regulations and tax laws adds another layer of complexity. Rules vary across jurisdictions, and staying compliant requires meticulous tracking and reporting. This can be daunting without software designed for these requirements. The complexity of cryptocurrency accounting often necessitates consulting with specialized financial professionals. While professional advice is valuable, specialized software can assist with compliance workflows, making it easier to stay on top of your obligations.

Integration difficulties

Integrating crypto transaction data with your existing accounting systems can be a major challenge. Traditional accounting software often struggles with the decimal places required for crypto transactions, leading to discrepancies and reconciliation issues. Traditional fiat accounting software often uses fewer decimal places than required for accurate crypto accounting. This incompatibility creates significant roadblocks to a smooth and accurate financial close. Specialized crypto accounting software bridges this gap, allowing seamless integration with your existing financial systems.

Top crypto accounting software options

Here’s a look at some popular crypto accounting software choices, including features and what they do best. Finding the right fit for your business depends on your specific needs and transaction volume.

Cryptoworth

Cryptoworth offers direct integration with QuickBooks Online (QBO) for managing cryptocurrency assets. This eliminates manual crypto tracking within QBO. The software automates crypto transaction imports, saving you time and reducing errors. It’s designed for businesses and accounting firms that need a streamlined way to manage crypto finances.

SoftLedger

SoftLedger is built for businesses working with cryptocurrencies. This software automates many crypto tracking and reporting tasks. It helps simplify complex accounting, providing a clearer picture of your financial position.

Bitwave

Bitwave provides a digital asset finance platform for businesses, including tools that support crypto tax workflows, accounting, and internal compliance. This helps businesses stay on top of regulations while managing crypto assets.

TokenTax

TokenTax focuses on crypto tax software. It offers seamless exchange integration, automated tax calculations, and detailed reporting. This simplifies crypto tax reporting, giving you peace of mind during tax season.

CoinTracker

CoinTracker aims to simplify crypto tax reporting and portfolio management. The software offers a user-friendly way to track crypto investments and ensure accurate tax reporting. It’s a good option for individuals and businesses looking for an easy-to-use platform.

CoinLedger

CoinLedger helps manage crypto revenue throughout the tax year. The platform supports over 300 major exchanges, NFTs, and wallets. This broad compatibility makes it a versatile choice for users with diverse crypto holdings.

Cryptio

Cryptio is accounting software for businesses handling digital assets like cryptocurrency. It helps companies manage finances, comply with regulations, and prepare for audits. Cryptio provides tools for financial control and audit readiness, giving businesses a comprehensive solution.

Why Cryptoworth Stands Out

While all the crypto accounting software platforms listed above offer valuable features, Cryptoworth sets itself apart with its deep integration into traditional accounting tools like QuickBooks Online, real-time automation, and enterprise-ready scalability. Unlike other tools that focus solely on tax reporting or portfolio management, Cryptoworth delivers a full-stack solution tailored for businesses and accounting firms managing high transaction volumes. With robust audit readiness, accurate reconciliation, and seamless crypto-to-fiat workflows, Cryptoworth is simply better equipped to handle the complexities of modern digital asset finance — making it the smarter, future-proof choice for serious crypto operations.

Essential features to look for

Before committing to any crypto accounting software, make sure it covers these essentials:

Multi-exchange and wallet integration

Your software should connect with all the exchanges and wallets you use. This simplifies tracking and puts all your data in one place. Look for software like Cryptoworth that supports a wide range of integrations. Broad compatibility saves you from manual data entry and reduces errors.

Automated transaction tracking and categorization

Automated tracking and categorization are key for efficiency. The software should automatically import transactions, categorize them, and calculate cost basis. This frees up your time for more important tasks. Aquifer CFO discusses automation's importance in crypto accounting.

Compliance and tax reporting tools

Having accurate records makes tax preparation easie. Your software should support tax reporting by generating exportable gain/loss and disposition reports. Some tools focus on this, offering comprehensive tax reporting for individuals. Make sure your chosen software fits your tax reporting needs.

Security and data protection

Security is critical with financial data. Look for software with strong security measures, like 256-bit encryption and compliance with industry best practices. Cryptoworth , for instance, highlights its security features for users concerned about data protection.

Integration with traditional accounting systems

If you use traditional accounting software like Xero, QuickBooks, or NetSuite, your crypto accounting software should integrate seamlessly. This streamlines your financial management by connecting all your data. Cryptoworth offers integrations with these popular tools, creating a unified financial system.

DeFi protocol support

Decentralized finance (DeFi) is constantly changing. Your software should keep up by supporting DeFi protocols and transactions. Platforms like CoinLedger offer broad support for various DeFi protocols, so you can manage complex transactions. This is important for staying on top of your DeFi activity and keeping accurate records.

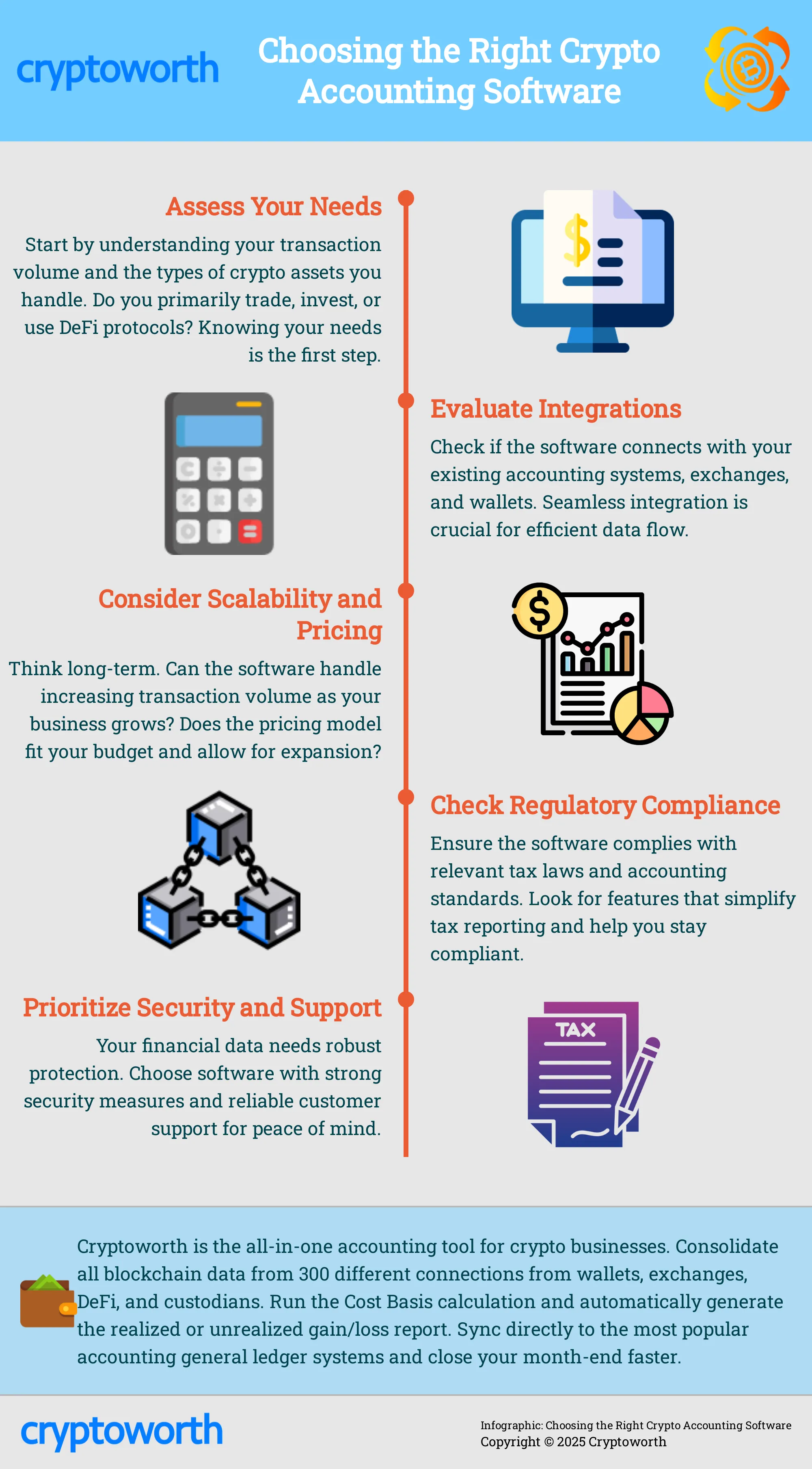

Choosing the right software for your business

Selecting the right crypto accounting software requires careful consideration of your specific business needs. It's like finding the right tool for a project—you wouldn't use a hammer to tighten a screw. Here's what to consider:

Assess your needs and transaction volume

First, understand your transaction volume. A small business with a few transactions won't need the same software as a large enterprise handling thousands. Missing even one transaction creates problems, so choose software that can handle your current and future needs.

Evaluate integration capabilities

Next, consider integrations. Does the software connect with your existing accounting software, wallets, and exchanges? Seamless data flow between platforms is essential. Using incompatible tools creates extra work and increases errors. Look for crypto-specific accounting tools designed for this.

Consider scalability and pricing

As your business grows, your software needs to scale with it. Choose software that can handle increasing transaction volumes and expanding operations. Also, consider pricing. Some platforms charge per transaction, others offer subscriptions. Find a model that fits your budget and allows for growth. Financial professionals specializing in digital currencies can offer helpful advice.

Check regulatory compliance features

Finally, ensure the software complies with regulations. Tax laws and accounting standards for crypto are always changing. The software should handle these updates and provide accurate reports for audits. Staying on top of regulatory changes is critical. Look for features that simplify tax reporting and ensure compliance.

Implementing crypto accounting software: Best practices

Successfully integrating new software takes planning and teamwork. These best practices can make the process smoother.

Steps for successful integration

Start by mapping your current crypto transaction workflow. Identify all your crypto transaction sources, like exchanges, wallets, and custodians. Understanding your data flow will help you configure the software to match your needs. Next, clean up your existing data. This might involve consolidating accounts or fixing inconsistencies. A clean start ensures accurate reports going forward. Finally, test the integration thoroughly before going live. A phased rollout with a small subset of your data can help you catch any issues early on.

Train your team and establish protocols

Your team needs to understand how to use the new software. Provide comprehensive training on the software's features and how it integrates with your existing accounting systems. Clear protocols are also essential. Document the steps for recording transactions, reconciling accounts, and generating reports. This ensures everyone follows the same procedures, reducing errors and maintaining consistency. Because crypto accounting can be complex, consider consulting with financial professionals specializing in digital currencies.

Data migration and reconciliation strategies

Migrating your historical crypto transaction data is critical. Work with your software provider to develop a data migration plan that minimizes disruption. This often involves exporting data from your current systems and importing it into the new software. Thorough reconciliation is key after the migration. Compare your old records with the new data in the software to ensure everything transferred correctly. If you've been using spreadsheets or other manual methods, this is a good time to switch to a more automated approach. Many crypto accounting software solutions offer APIs or CSV imports to streamline this process.

Common misconceptions

Let's clear up a few common misconceptions about crypto accounting software. These myths can lead to costly mistakes, so it's good to address them head-on.

"All crypto accounting software is the same"

This isn't true. Crypto accounting solutions vary widely in features, capabilities, and integrations. Some specialize in DeFi or NFTs. Others focus on tax reporting or portfolio tracking. It's essential to choose software that meets your specific business needs. Choosing the wrong software can create more accounting errors later.

"Manual entry is sufficient"

Manual entry might work for a few transactions. It quickly becomes a problem as your crypto activity grows. Think about managing thousands of transactions across multiple exchanges and wallets. Manual entry is time-consuming and prone to errors. It makes it nearly impossible to keep up with tax reporting. Automated solutions handle this complexity. This frees up your time for more strategic tasks.

"Tax compliance is automatic"

Some software offers tools to help with tax reporting. Compliance isn't truly automatic. You're still responsible for your data's accuracy. You also need to understand tax laws. Using specialized crypto accounting tools simplifies the process. It reduces the risk of errors. It's still wise to consult a tax professional for advice.

"One-time setup is enough"

The crypto world is constantly changing. New regulations, tokens, and DeFi protocols emerge regularly. Your accounting software needs to adapt. A one-time setup isn't enough to stay compliant. Regular updates and ongoing training are essential. Consulting with financial professionals can also be helpful for long-term success.

"Integration isn't important"

Integration with your existing accounting systems is essential. It's key for accurate financial reporting. Separate systems for crypto and traditional finance create data silos. This increases the risk of errors. Seamless integration ensures all your financial data is accessible. This simplifies reconciliation and reporting. It also avoids decimal discrepancies between systems.

Maximize the benefits of your software

Getting the most from your crypto accounting software goes beyond the initial setup. It's about weaving it into your daily workflows to reshape how you handle finances. Here’s how:

Leverage real-time analytics

Real-time access to your financial data changes the game. You're always in the know, not just at month-end. This allows you to make informed decisions quickly. Tools like Tableau or Microsoft Power BI transform complex data into clear visuals, revealing hidden trends. No more endless spreadsheets—get the insights you need, instantly.

Streamline month-end closing

Month-end closing shouldn't be a headache. Crypto accounting software automates the tedious tasks: tracking transactions, calculating gains and losses, and creating compliant reports. This reduces manual work, minimizes errors, and speeds up the closing process. Your team gains time for strategic work or simply a breather.

Ensure accurate reporting and audits

Accuracy is key in crypto accounting. Specialized software helps prepare audit-ready financial records, compliant with standards like US GAAP and IFRS. Because of the complexities of cryptocurrency, working with financial professionals specializing in digital currencies is a good idea. They can offer expert advice and ensure you're on track. This resource provides more information on handling crypto accounting challenges. With organized records and proper documentation, audits become easier to navigate

Whether you manage dozens of wallets or complex blockchain transactions, Cryptoworth makes month-end crypto accounting easier than ever. Stay audit-ready and confident with a solution built for modern finance teams.

Emerging Trends

Crypto accounting software is constantly evolving. Here’s a look at some key trends shaping the future of the industry:

Enhanced Integrations with Traditional Systems

Many general ledger accounting software solutions don’t support crypto assets. Businesses often resort to makeshift solutions using spreadsheets, crypto tax tools, and other add-ons. This fragmented approach creates extra work for accounting teams. Modern crypto accounting software aims to solve this by integrating directly with existing financial systems like QuickBooks or Xero. This streamlined approach simplifies managing crypto assets alongside traditional currencies.

Advanced Real-Time Reporting and Analytics

Real-time data access is essential for sound financial decision-making. The best crypto accounting platforms offer this, giving you up-to-the-minute insights into your financial position. Some platforms even integrate with advanced analytics tools like Tableau and Microsoft Power BI. This lets you visualize complex financial data, uncover hidden patterns, and make data-driven decisions.

If you want to turn those analytics and insights into a professional, data-driven report for your team or stakeholders, you can easily create one using an AI presentation maker, transforming complex crypto data into clear visuals.

Improved Support for Multiple Currencies and Blockchains

Blockchain technology is changing accounting and auditing, bringing greater transparency and security. As this technology evolves, accounting software must keep up. Support for a wide range of cryptocurrencies and blockchain networks is no longer optional—it’s essential. This ensures accurate and secure financial reporting in today’s complex crypto environment.

User-Friendly Interfaces for Non-Accountants

Crypto accounting software isn’t just for seasoned accountants anymore. Modern solutions offer intuitive, user-friendly interfaces. This makes it easier for team members without a deep accounting background to manage crypto finances effectively. This broader accessibility empowers more people within an organization to contribute to financial management.

Related Articles

Frequently Asked Questions

What's the biggest difference between regular accounting software and crypto accounting software?

Regular accounting software isn't designed for the unique aspects of cryptocurrency, like fluctuating values, complex transaction tracking across various platforms, and specific tax reporting requirements. Crypto accounting software addresses these differences, automating tasks like cost-basis calculations and generating reports that support tax preparation. It also handles the many decimal places often found in crypto transactions, something traditional software struggles with.

Do I need crypto accounting software if I only have a few crypto transactions?

While manual tracking might work for a small number of transactions, it becomes difficult and error-prone as your crypto activity increases. Even a few missed or misclassified transactions can cause problems during tax season or audits. Crypto accounting software helps avoid these issues from the start, ensuring accuracy and saving you time.

Can crypto accounting software handle all types of crypto transactions, including DeFi and NFTs?

Not all software offers the same level of support. Some platforms specialize in specific areas like DeFi or NFTs, while others offer broader functionality. When choosing software, make sure it covers the types of transactions you regularly conduct. If you're heavily involved in DeFi, for example, choose software that specifically supports DeFi protocols and calculations.

How does crypto accounting software help with tax reporting?

Crypto accounting software automates many of the tedious tasks associated with crypto tax reporting. It tracks transactions, calculates gains and losses, and generates reports that comply with tax regulations. While the software simplifies the process, remember that you're still responsible for the accuracy of your data and understanding relevant tax laws. Consulting a tax professional is always a good idea.

What should I look for when choosing crypto accounting software for my business?

Consider your specific needs, including transaction volume, the types of crypto assets you hold (DeFi, NFTs, etc.), and any integrations with existing accounting systems. Look for features like automated transaction tracking, support for multiple exchanges and wallets, robust security measures, and compliant tax reporting tools. Also, think about scalability – can the software grow with your business? Finally, consider the pricing structure and ensure it aligns with your budget.